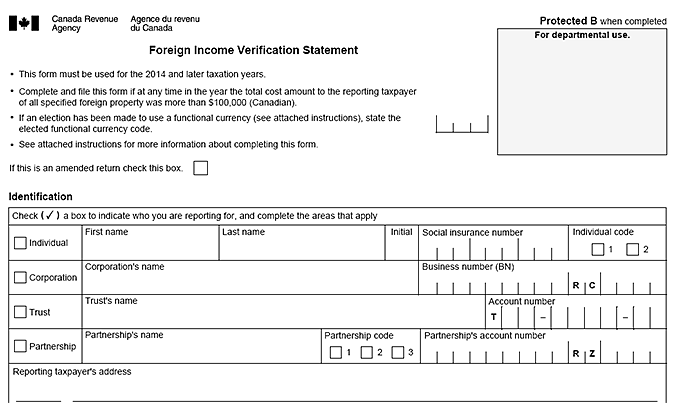

The new Specified Foreign Property feature on the Marketable Securities working paper is a great time-saving tool when completing section 6 of the CRA's form "T1135 Foreign Income Verification Statement".

The new Specified Foreign Property feature on the Marketable Securities working paper is a great time-saving tool when completing section 6 of the CRA's form "T1135 Foreign Income Verification Statement".

Form T1135 covers the reporting of total foreign property owned by a taxpayer. A taxpayer must report their foreign property if it is valued over $100,000 during the year.

| Please note if the total cost amount of foreign property reaches more than $100,000 at any point during the year, it must be reported. The MS working paper helps determine if this threshold has been reached during the year. |  |

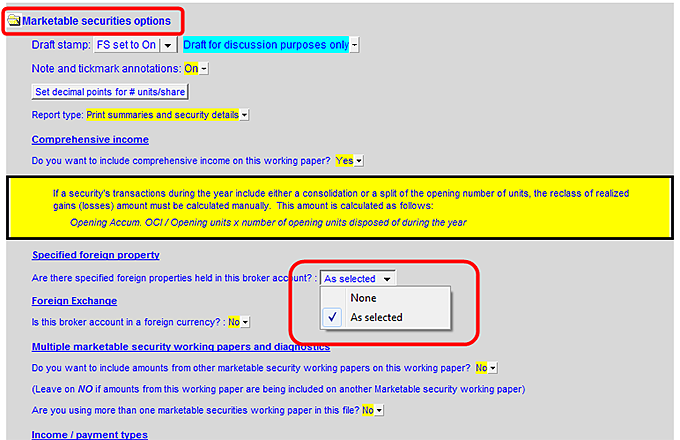

| To enable this feature, check the dropdown under “Specified foreign property” in the Marketable securities options area and choose the “As selected” from the menu. |  |

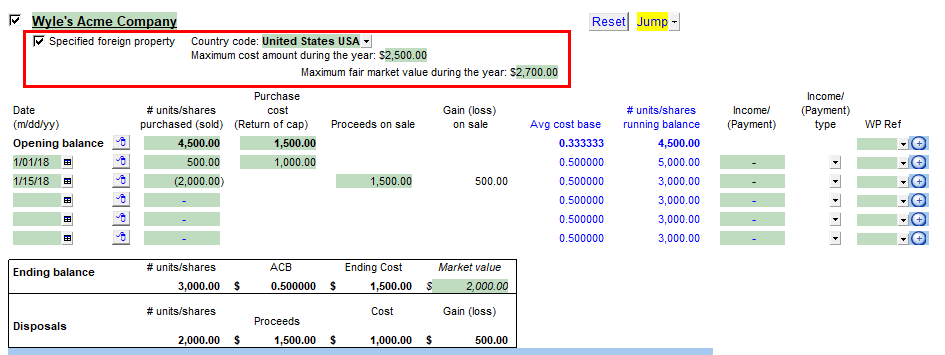

| In each Securities details area, check off the Specified foreign property checkbox to classify the security as a foreign property. If you do not see this checkbox, make sure “As selected” has been selected in the Marketable securities options area (see above). Maximum cost amount during the year will be automatically calculated based on transactions entered for the security. Maximum fair market value must be entered directly from the broker statements. Country code will be listed in the Specified foreign property tables (see right). |  |

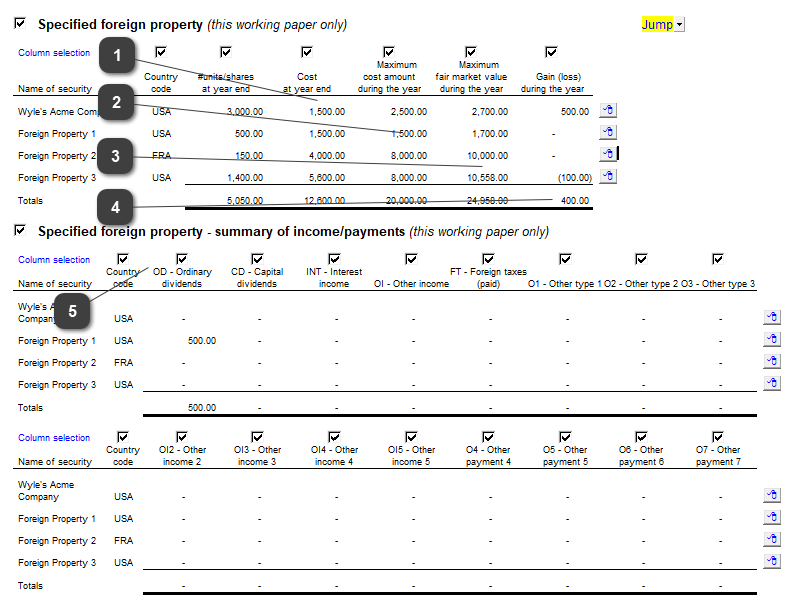

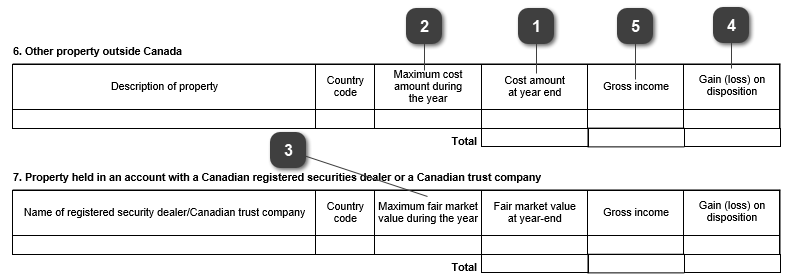

| The information required for part 6 of the T1135 is summarized in the Specified foreign property tables. The tables are located in the upper part of the working paper alongside the other summaries. The accompanying screenshot is labeled to show where each item in the Specified foreign property tables corresponds to part 6 & 7 of the T1135 form. |

Specified Foreign Property Tables

|

|

|